Life Insurance Premium Payment options: Limited Pay vs Regular Pay; Which one is better?

Limited pay vs regular pay – it is easy to get confused between options for your life insurance premium payment. While Life insurance plays a crucial role in securing the financial future of your loved ones it is important to delve deeper into the two most common payment structures – Limited Pay vs Regular Pay and empower yourself to take informed decisions.

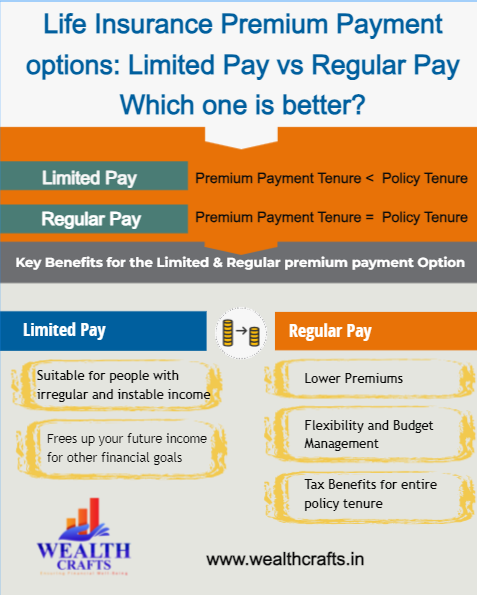

Limited Pay vs Regular Pay – 2 premium payment options:

Regular Pay:

In the regular pay option, you make consistent premium payments throughout the entire policy term. This method is similar to paying monthly installments for utilities or rent.

Example: Consider a 30-year term life insurance policy with a yearly premium of ₹20,000. You would need to pay ₹20,000 per year for the entire duration, totalling ₹6,00,000 over the policy term.

3 Key Benefits for the Regular premium payment Option:

- Lower Premiums: Regular pay premiums are generally lower compared to limited pay options. This is because the cost of the policy is spread evenly across a longer period.

- Flexibility and Budget Management: Smaller, more manageable payments can be easier to integrate into your budget, especially if your income fluctuates or you anticipate changes in your financial situation.

- Tax Benefits: Premiums paid towards life insurance policies qualify for tax deductions under Section 80C of the Income Tax Act, 1961. This provides additional financial relief, making regular pay even more attractive.

Limited Pay:

Limited pay allows you to complete premium payments for a specific period, which is shorter than the actual policy term. After completing the payments, your coverage remains active for the entire policy term without any further payments.

Example: You choose a 30-year term life insurance policy with a 10-year limited pay option. You might have a higher yearly premium, say ₹50,000, but you only need to pay for 10 years, totalling ₹5,00,000. Your coverage continues for the full 30 years without any further payments.

2 key Benefits of Limited Premium payment option:

- Suitable for people with irregular and instable income: Once you complete the limited pay period, you are no longer obligated to make payments, even if your income decreases or job loss. This ensures continued coverage without worrying about future expenses.

- Financial Security: Having one less recurring expense frees up your future income for other financial goals like retirement savings, children’s education, or debt repayment.

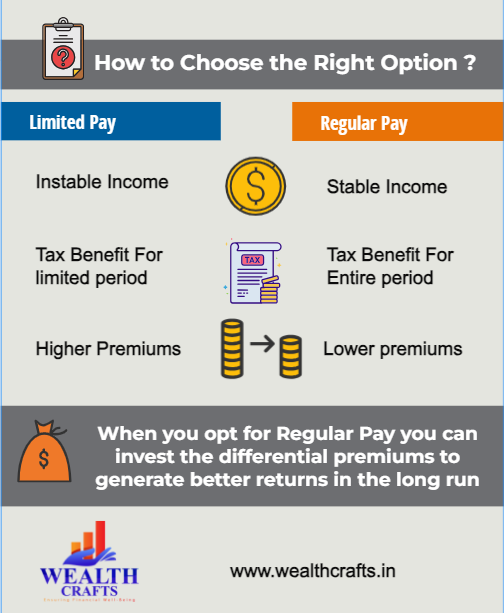

Limited Pay vs Regular Pay – How to Choose the Right Option :

The optimal choice of Limited Pay vs Regular Pay depends heavily on your individual circumstances and financial goals. Here are some crucial factors to consider:

- Income Stability: If you have a stable income, like a government job or a well-established business, regular pay with its lower premiums might be more suitable. However, if you are self-employed or have an uncertain income stream, limited pay can offer peace of mind in case of income fluctuations later in life.

- Financial Goals: Consider your long-term financial goals. If you are planning for major expenses like a child’s wedding or your retirement, regular pay might free up capital for investments that offer potentially higher returns compared to your life insurance policy’s cash value.

- Inflation impact in Limited Pay vs Regular Pay: India experiences fluctuating inflation rates. While limited pay might seem attractive initially, remember that the premiums are fixed, unlike regular pay which can be adjusted for inflation through premium riders offered by some life insurance companies.

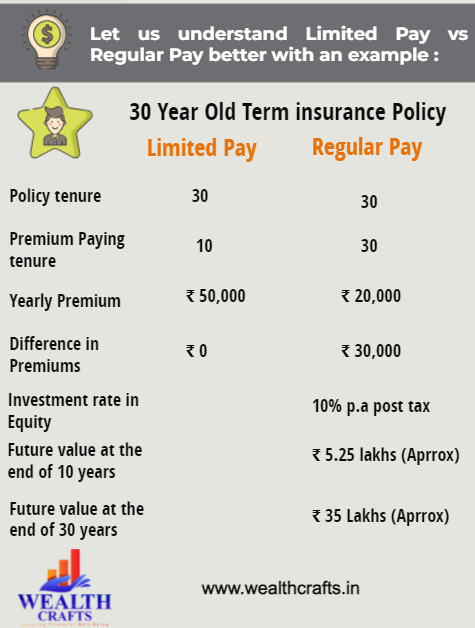

Let us understand Limited Pay vs Regular Pay better with an example :

In Regular Premium payment option, a 30-year term life insurance policy with a yearly premium of ₹20,000. You would need to pay ₹20,000 per year for the entire duration, totaling ₹6,00,000 over the policy term.

In a 30-year term life insurance policy with a 10-year limited pay option. You might have a higher yearly premium, say ₹50,000, but you only need to pay for 10 years, totaling ₹5,00,000.

You may feel that the limited payment option is cheaper but let us dig into the present value of the total premiums paid. Look at the below table you are paying premiums over the entire policy tenure in the first option, where the present value of Rs. 20,000 is not equal to the future value of Rs.20,000 in 10th, 20th or 30th year because of the inflation factor.

The present value of 10th year RS. 20,000 premiums considering 5% inflation is around Rs. 12,200 [(20,000/(1+inflation) ^number of years) =20000/1.05^10 = Rs. 12,278)

The present value of 20th year RS. 20,000 premiums considering 5% inflation is around Rs. 7,600 [(20,000/(1+inflation) ^number of years) =20000/1.05^20 = Rs. 7,537)

The present value of 30th year RS. 20,000 premiums considering 5% inflation is around Rs. 4,700 [(20,000/(1+inflation) ^number of years) =20000/1.05^30 = Rs. 4,627)

| Year | Regular pay | Limited pay |

| Annual premiums | Annual premiums | |

| 1 | -20,000 | -50,000 |

| 2 | -20,000 | -50,000 |

| 3 | -20,000 | -50,000 |

| 4 | -20,000 | -50,000 |

| 5 | -20,000 | -50,000 |

| 6 | -20,000 | -50,000 |

| 7 | -20,000 | -50,000 |

| 8 | -20,000 | -50,000 |

| 9 | -20,000 | -50,000 |

| 10 | -20,000 | -50,000 |

| 11 | -20,000 | 0 |

| 12 | -20,000 | 0 |

| 13 | -20,000 | 0 |

| 14 | -20,000 | 0 |

| 15 | -20,000 | 0 |

| 16 | -20,000 | 0 |

| 17 | -20,000 | 0 |

| 18 | -20,000 | 0 |

| 19 | -20,000 | 0 |

| 20 | -20,000 | 0 |

| 21 | -20,000 | 0 |

| 22 | -20,000 | 0 |

| 23 | -20,000 | 0 |

| 24 | -20,000 | 0 |

| 25 | -20,000 | 0 |

| 26 | -20,000 | 0 |

| 27 | -20,000 | 0 |

| 28 | -20,000 | 0 |

| 29 | -20,000 | 0 |

| 30 | -20,000 | 0 |

| NPV | ₹ -3,07,449.02 | ₹ -3,86,086.75 |

After considering the inflation factor of 5% per annum the Net present value of the total premiums paid in regular pay option is ₹ 3,07,500 whereas in the limited pay option it is ₹ 3,86,000 which is costlier due to the higher premiums paid in the initial years.

- Tax Implications in Limited Pay vs Regular Pay: Though both options offer tax benefits under Section 80C, with regular pay, you can claim tax deductions for a longer period, potentially leading to greater cumulative tax savings.

- Rider Availability in Limited Pay vs Regular Pay: Some life insurance riders, like critical illness coverage or accidental death benefit, might have different premium payment options compared to the base policy. Ensure you understand the specific payment structure for each rider you choose.

Both Limited Pay vs Regular Pay options have their advantages and disadvantages. Choosing the right option requires careful consideration of your financial situation, future plans, risk tolerance, and the unique financial landscape of India. Consulting a qualified financial advisor through a free introductory call today can be invaluable in this process. They can help you analyze your specific needs, understand the nuances of each option and recommend the best payment structure for your life insurance policy, ensuring optimal financial security for your loved ones.

Read this if you want to understand how much insurance you need.

Related Articles

What should you do with your life insurance policy – 3 options to choose from: Continue/Surrender/Paid-Up policy

Confused about what should you do with your life insurance policy? In Indian families, pressure to buy traditional life insurance policies can be strong and multifaceted. Parents often play the “security card,” emphasizing the importance of ...How much life insurance do you need?

Insurance is an important tool of risk mitigation and a critical aspect of financial planning. Life insurance allows an individual to ensure that his loved ones and financial dependents can continue to lead a decent life and meet their expenses. Life ...Direct Funds vs Regular Funds – Are Direct Mutual Funds Better?

An Introduction to Mutual Funds Before we get into Direct Funds vs Regular Funds lets understand about mutual funds. Mutual funds offer investors easy access, liquidity, and straightforward exits, while also transferring investment management risk to ...Old vs New Tax Regime Which is Better

Old vs New Tax Regime Which is Better, confused between them? The Union Budget of 2020 presented by the Finance Minister brought in a radical change by presenting two tax rates and slabs applicable from the financial year 2020-21. The union budget ...Hatchback Vs SUV – Long-term Impact

Before choosing between Hatchback Vs SUV, first let us understand whether you should really buy a car or can manage with hiring/ renting a cab. Buying a car in India is a significant milestone. It brings freedom, convenience, and a new joy to daily ...